The New Agrochemical Landscape: 501 Proposed Registrations Reveal Trends in Competition and Innovation

Recently, the Institute for the Control of Agrochemicals, Ministry of Agriculture and Rural Affairs (ICAMA) of China, released its latest list (9th batch of 2025) of agrochemical products proposed for registration. This announcement, which includes 501 new products and 119 registration amendments, is more than just a routine administrative notice; it serves as a crucial bellwether for the future direction of China's agrochemical market. It clearly reveals which products are set to enter the market, which active ingredients are becoming fiercely competitive, and what new opportunities are quietly emerging.

For industry stakeholders, the value of this list is self-evident. Agrochemical companies can use it to anticipate market dynamics, adjust their R&D and marketing strategies, while for registration professionals, it provides invaluable firsthand data for optimizing approval processes and evaluating the rationality of current standards.

Key Highlight: 26 Technical Concentrate (TC) Registrations Unveil Industry Dynamics

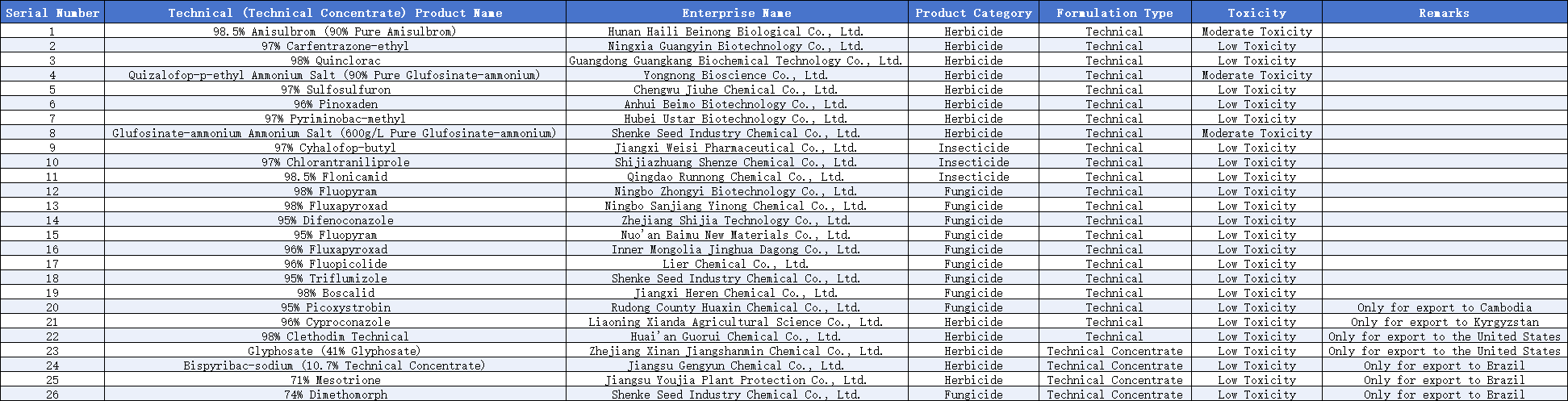

Among the numerous products in this announcement, the 26 new Technical Concentrate (TC) registrations are undoubtedly the centerpiece of the analysis, as they represent the earliest movements in the industry's value chain. This batch includes 22 Technical Grade products and 4 Technical Concentrates, with five of them specifically designated as "for export only," signaling the global ambitions of Chinese agrochemical firms.

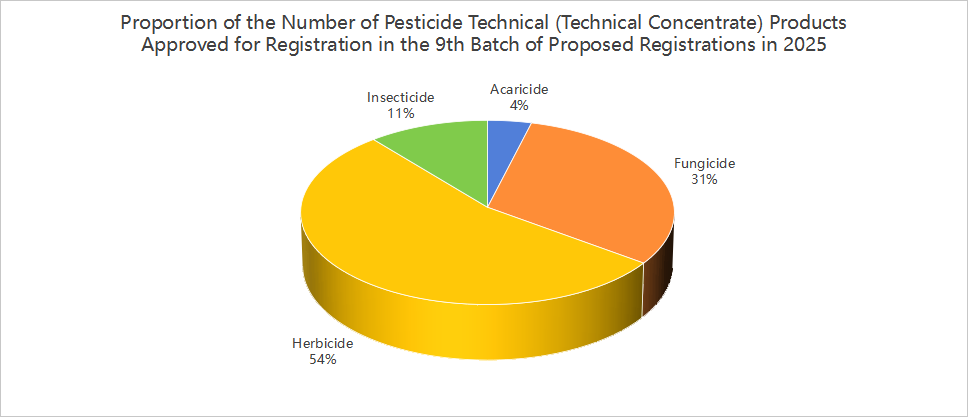

The market structure is distinctly clear from a categorical perspective:

Herbicides: With 14 registrations (a commanding 54% share), they dominate the landscape, reaffirming their status as the largest market category.

Fungicides: Following with 8 registrations (31%), this is an active area for technical innovation.

Insecticides and Acaricides: With 3 and 1 registrations respectively, these are mature and popular products, though fewer in number.

A particularly positive signal is that none of the proposed TCs are classified as highly or acutely toxic. Low-toxicity products account for nearly 90% (88.46%), aligning perfectly with the global agricultural trend towards green, environmentally friendly, and sustainable development.

Three Key Market Trends

A deeper analysis of this list reveals three core trends shaping the current agrochemical market:

1. Fierce Competition in Hot-Ticket Active Ingredients

Competition over popular active ingredients has become white-hot. In fungicides, for example, a single ingredient, Fluopyram, accounts for 4 TC registrations, representing nearly half of all new fungicide TCs in this batch. Similarly, herbicide ingredients like Glufosinate-P and Metazachlor also saw multiple companies filing for registration, signaling that the future battle for market share around these mature products will be exceptionally intense. For businesses, this means facing significant cost and marketing pressures when entering these fields.

2. Emerging New Ingredients: A Double-Edged Sword of Opportunity and Challenge

On the flip side of intense competition, the emergence of new ingredients is injecting fresh vitality into the market. Two cases from this announcement are particularly noteworthy:

Picoxystrobin: A high-performance strobilurin fungicide, its TC saw its first registration under the new policy. This could mark the opening of a new, high-potential market segment, offering a valuable opportunity for companies seeking differentiation.

Cinmethylin: The TC for this herbicide ingredient (for export only to Kyrgyzstan) marks its first-ever registration in China. This is not just a product breakthrough but also reflects a strategic approach by Chinese companies to leverage their manufacturing advantages to provide customized solutions for specific overseas markets.

The introduction of new ingredients presents both opportunities and challenges related to market education and channel development, testing the comprehensive strength of companies.

3. A Clear Export-Oriented Strategy and Accelerated Global Expansion

In this batch, Shenyang Sciencreat Chemicals Co., Ltd. delivered an impressive performance, leading with 3 TC registrations (including export-only products). Furthermore, products like Mesotrione TC also saw multiple export-only registrations. This clearly indicates that a growing number of Chinese agrochemical companies are no longer content with the domestic market and are setting their sights on the global stage. This export-oriented growth is becoming a key engine for the industry's development.

Conclusion and Outlook

Overall, the 9th batch of proposed agrochemical registrations for 2025 paints a vivid picture of the market: on one hand, competition for mature products is intensifying due to homogenization; on the other, technological innovation and global expansion are continuously opening up new avenues for growth.

For the agrochemical companies navigating this landscape, the road ahead is paved with both opportunities and challenges. Relying solely on "me-too" strategies for popular products will face increasing pressure. In contrast, companies that can embrace green trends, actively pursue R&D and innovation, and adopt a global perspective will be better positioned to succeed in the competitive market of the future, contributing significantly to global agricultural production and food security.