A Signal of Recovery in the US Agrochemical Market: Surge in H1 2025 Approvals Creates New Opportunities for Global Players

As we enter the second half of 2025, the U.S. agricultural chemical market is demonstrating a strong recovery and dynamic growth potential. The most significant indicator of this trend is a decisive acceleration in the U.S. Environmental Protection Agency's (EPA) pesticide approval process. This shift is not only invigorating the global agrochemical sector but also clearly outlining current market demand hotspots and future trends.

Approval Efficiency Returns, Boosting Market Confidence

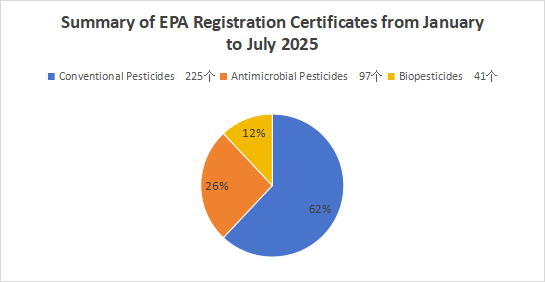

In the first half of 2025, the efficiency of the U.S. EPA's pesticide approvals has taken a quantum leap. As of July, a total of 363 new pesticide registrations have been approved—a figure that surpasses the entire total for 2024 in just six months. This unprecedented pace indicates that the EPA's internal efficiency-boosting measures are taking effect, with the regulatory rhythm steadily returning to a healthy, pre-pandemic level.

Among these new registrations, Technical Grade Active Ingredients (TGAI) are the dominant category, accounting for over 85% of the total, which reflects strong demand for raw material access at the top of the supply chain. In terms of product categories, herbicides remain the most registered group, followed by insecticides and fungicides, a structure consistent with the traditional agrochemical market.

Three Hot Sectors: A Glimpse into Core Market Demand

An analysis of the more than 200 approved active ingredients reveals several key trends in the current U.S. market:

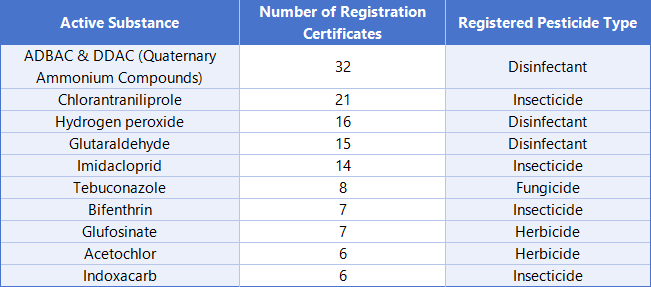

Stable Demand in Public Health and Facility Disinfection: Disinfectant products continue to be a popular registration category. Quaternary ammonium compounds (32 registrations), hydrogen peroxide (16), and glutaraldehyde (15) lead the pack, highlighting the sustained, essential need for disinfection in public health and agricultural facilities in the post-pandemic era.

High-Efficacy Insecticides in High Demand: Chlorantraniliprole stands out as the undisputed "star product" with an impressive 21 registrations. This not only solidifies its market position as a broad-spectrum, high-efficacy insecticide but also signals its increasingly central role in future crop protection programs.

Biopesticides on a Fast Track to Diversification: Biopesticide registrations are showing greater diversity and specialization. Microbial agents, led by Bacillus species (9 registrations), represent the mainstream force. At the same time, other categories such as insect pheromones, plant-derived extracts, and plant growth regulators have also gained significant attention, indicating growing market acceptance of green and sustainable crop protection solutions.

The Rise of Chinese Players and Future Strategic Considerations

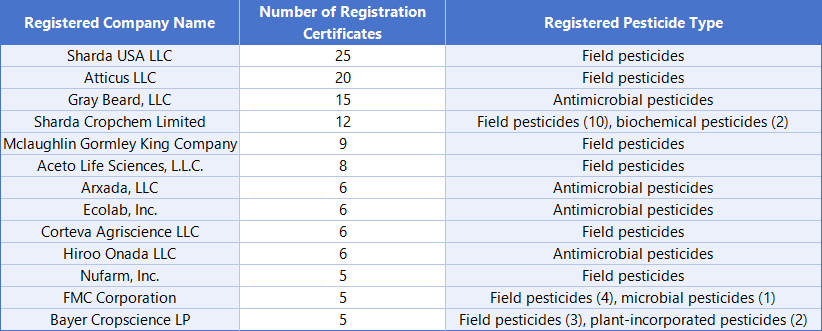

In the midst of this market opportunity, the performance of Chinese agrochemical companies is particularly noteworthy. In the first half of 2025, 11 Chinese firms successfully secured 18 EPA registrations, demonstrating their strong commitment to the North American market and their growing global competitiveness. In terms of product focus, these companies are closely following market trends, concentrating on major products like clethodim (3 registrations) and chlorantraniliprole (3 registrations).

However, beneath this success lies a clear strategic gap. The vast majority of registrations from Chinese companies are for technical grade active ingredients, with an insufficient presence in end-use formulation products that directly target end-users.

Outlook and Recommendations: The Leap from Raw Material Supplier to Brand Builder

For Chinese companies aiming to penetrate the North American market more deeply, current opportunities and challenges go hand in hand. While the accelerated EPA approval process opens the door to the market, true success goes beyond selling raw materials. The key to future competition lies in moving down the value chain. A dual-track strategy is urgently needed:

Move Downstream with Federal Formulation Registrations: This is a crucial step in transitioning from a raw material supplier to a solution provider. It allows for direct access to the end-user market, enhancing brand influence and profit margins.

Ensure Market Access with State-Level Registrations: Actively pursuing and completing state-level registrations is the "last mile" for product commercialization, ensuring that products can be legally sold across different states.

In summary, the market dynamics of the first half of 2025 signal the beginning of a new growth cycle. For well-prepared Chinese companies, this is a strategic window of opportunity to make the leap from simply "exporting products" to "building global brands."