Brazil's Agribusiness Sector Expands Significantly, with 32,000 New Firms Highlighting a Supply Chain Localization Trend

A recent industry report has revealed the robust growth momentum of Brazil's agricultural sector. According to exclusive data from IPC Maps, nearly 32,000 new agriculture-related businesses were established in Brazil between April 2024 and April 2025. This has pushed the country's total number of agricultural enterprises to 868,870, further cementing its status as a global agricultural powerhouse.

Core Driver: Synergistic Growth in the Crop Protection Value Chain

In this wave of expansion, the development of the crop protection (pesticide) sector is particularly noteworthy. Its growth is not a surge in a single segment but a coordinated strengthening of the entire value chain.

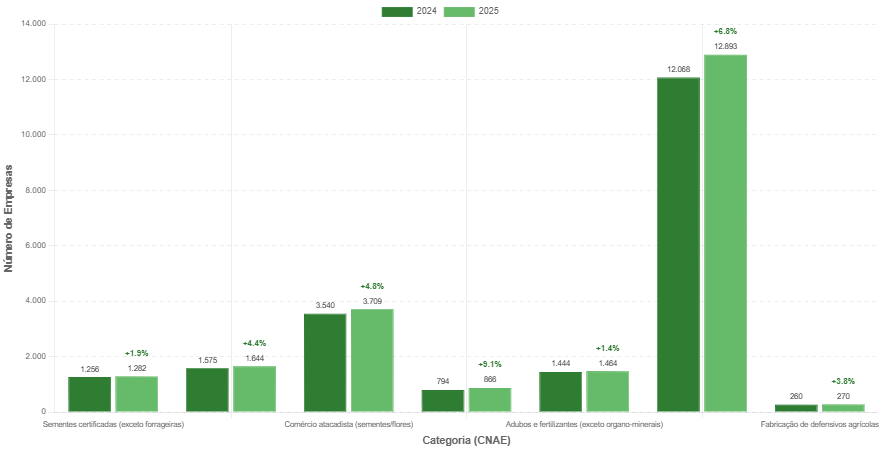

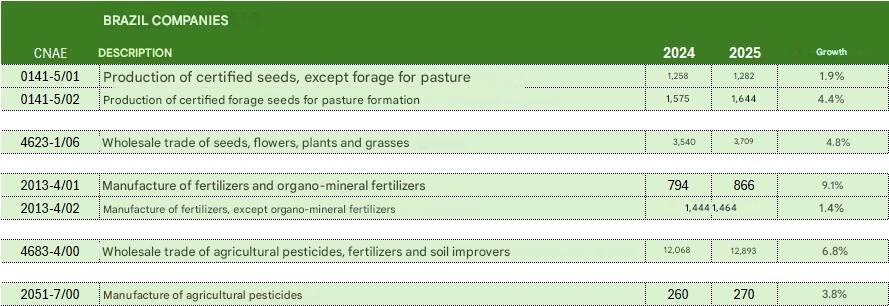

Manufacturing Upgrade: The number of pesticide manufacturing companies saw an annual growth of 3.8%, rising from 260 to 270. According to expert analysis, the emergence of these 10 new manufacturers signals a move towards deeper industry integration and technological advancement, reflecting growing domestic demand for efficient and sustainable agricultural inputs and a strategic push for greater national production autonomy.

Distribution Network Expansion: Even more significant was the 6.8% growth rate in the distribution channel, with 825 new wholesale trading companies for crop protection products, fertilizers, and soil conditioners established. This phenomenon demonstrates the resilience and dynamism of Brazil's agricultural distribution chain. A robust distribution network is the lifeline ensuring that agricultural inputs effectively reach producers across the country's vast territory.

Broad-Based Growth: The Agricultural Inputs Market Flourishes

The growth in the crop protection sector is not an isolated case but is reflective of a thriving trend across the entire agricultural inputs industry. Data shows that organo-mineral fertilizer manufacturing led the charge with a 9.1% increase, while conventional fertilizer manufacturing companies grew by 1.4%. The production of certified forage seeds for pasture establishment and related wholesale trade also saw solid growth of 4.4% and 4.8%, respectively.

Reshaping the Regional Landscape: The Midwest Emerges as a New Growth Hub

Geographically, Brazil's agricultural economic map is undergoing subtle yet profound changes. While the Southeast region continues to dominate with its massive base of nearly 750,000 companies, the real highlight is the Midwest. The region's total number of enterprises has reached 40,545, surpassing the South's 39,124 for the first time to become the nation's second-largest cluster of agricultural businesses. This shift reflects the ongoing expansion of Brazil's agricultural frontier and the rise of emerging markets. Major agricultural states like São Paulo, Minas Gerais, and Mato Grosso remain at the core of the market.

Strategic Importance: Cementing its Role as an Economic Pillar

The data from this report clearly indicates that the entire value chain, from production to distribution, is being strengthened. The healthy development of the crop protection industry is crucial for safeguarding Brazil's food productivity, enhancing the overall competitiveness of its agricultural economy, and reducing dependence on imports. The establishment of these nearly 32,000 new businesses not only creates significant employment opportunities but also reaffirms the status of the agribusiness complex as a cornerstone of Brazil's national economy.