Latin America's Green Gold Rush: Why the Biologics Market is a New Hub for Global Investment

A profound agricultural revolution is quietly unfolding in Latin America, making it a rapidly emerging hotspot for global investment in the biologics sector. In this vibrant region, countries led by Brazil are embracing sustainable agricultural solutions at an unprecedented pace, not only reshaping the regional agricultural landscape but also revealing a "blue ocean" of opportunity for global investors. Data shared by Mark Trimmer, President and co-founder of DunhamTrimmer, at a recent biocontrol and biostimulants event in Latin America, highlights the region's transformative potential in this field.

Brazil: The Powerful Engine Driving Global Growth

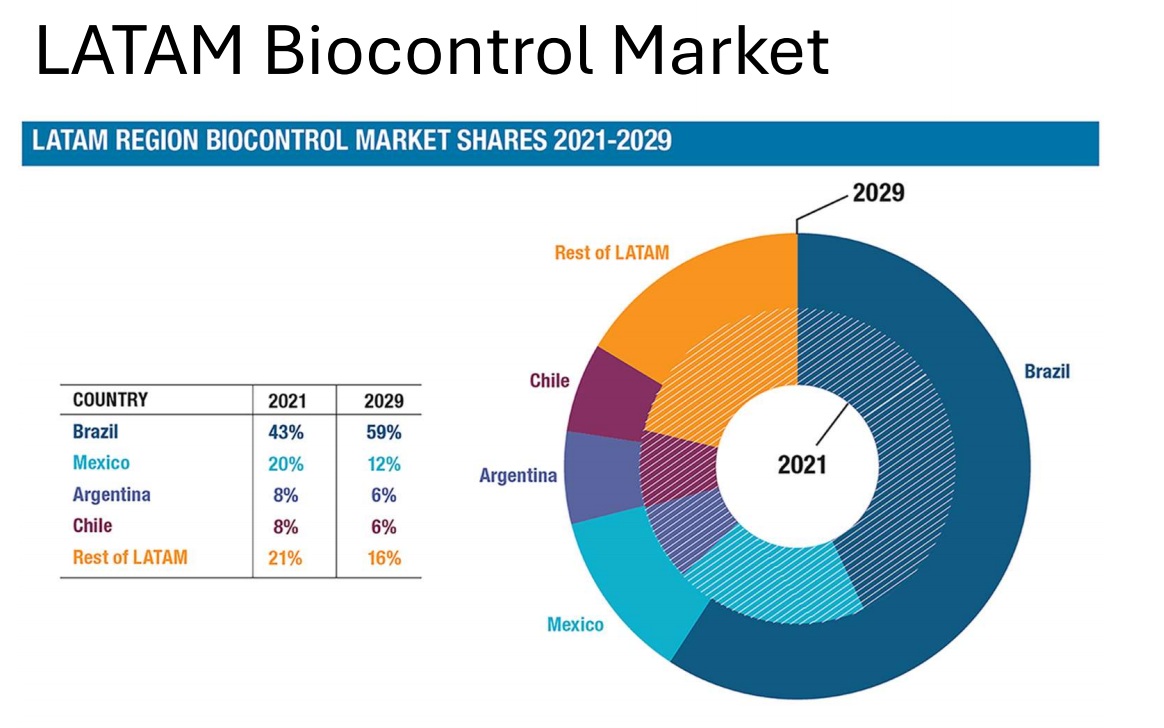

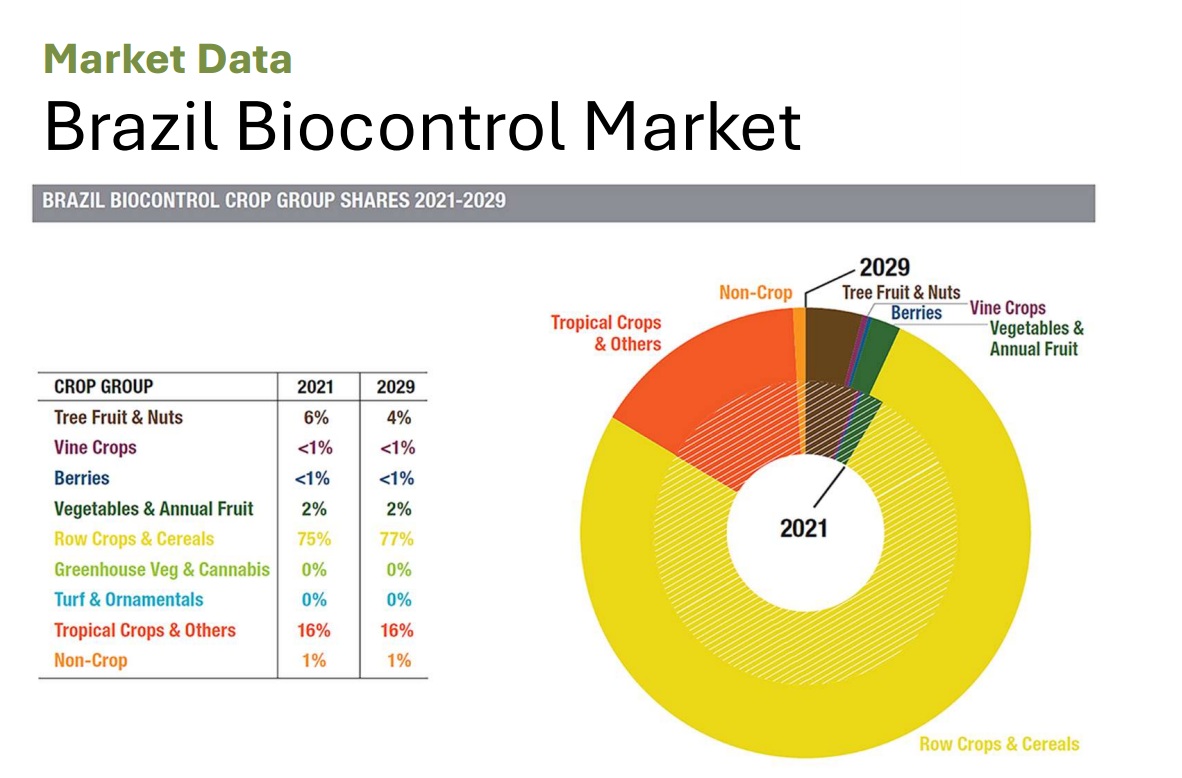

Any analysis of the Latin American biologics market must begin with Brazil. This agricultural giant is not just the regional leader but the core driver of global growth in the biocontrol market. Authoritative data shows that between 2021 and 2030, Brazil will contribute to over one-fifth of the global growth in the biocontrol market.

Its market expansion is remarkable: a market currently valued at over $1.5 billion is projected to double to more than $3 billion by 2029. This growth is not mere speculation but is built on a solid foundation of practice. Biological solutions have been adopted on over 50 million hectares of core row crops (like soy and corn) in Brazil, with the cumulative treated area exceeding 150 million hectares. With over 600 registered biocontrol products, Brazil's depth and breadth in large-scale application are unparalleled globally.

According to Trimmer, no other country in the world has achieved such a high level of biocontrol adoption in row crops, and Brazil's biocontrol market growth rate is 7% higher than the global average.

Regional Landscape: Diverse Market Opportunities

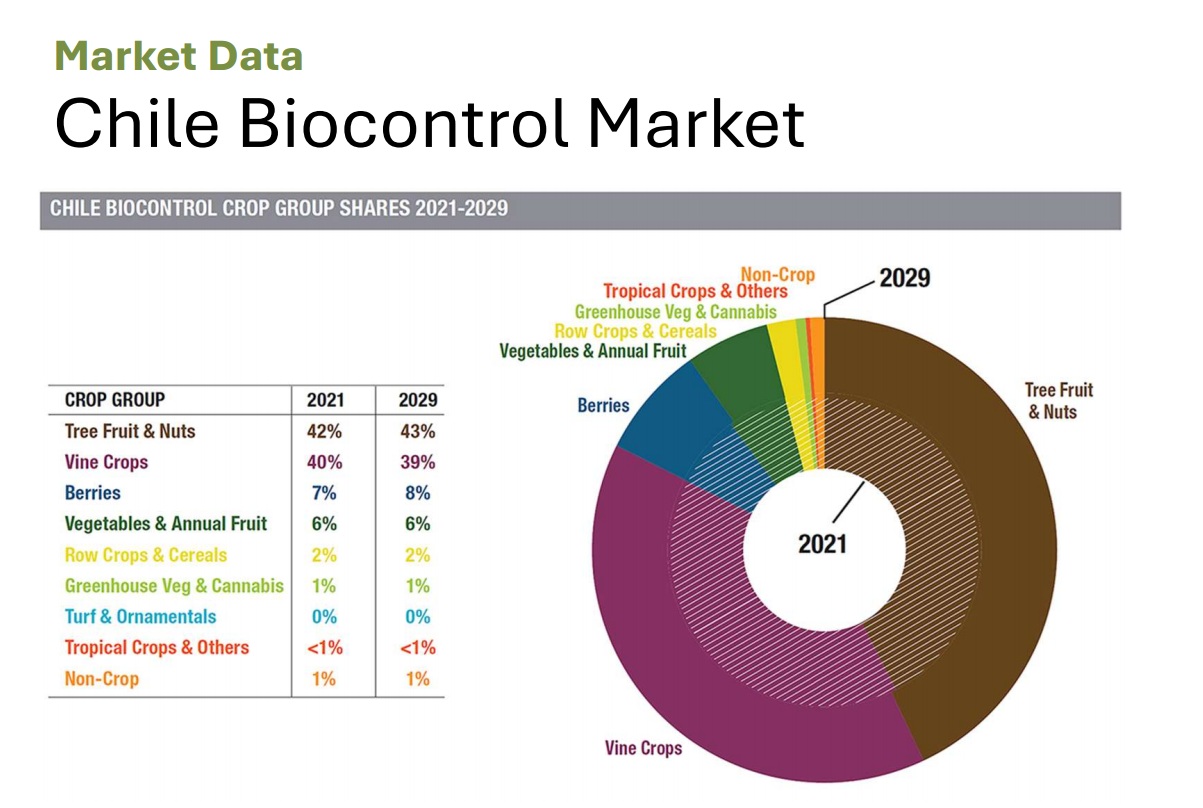

However, Latin America's appeal extends far beyond Brazil's scale. Other countries in the region exhibit differentiated market characteristics, offering diverse entry points for investors:

Chile - A Model for High-Value Agriculture: Leveraging its strong export-oriented agriculture, Chile applies biologics with precision to high-value crops like table grapes, fruits, and nuts. Unlike Brazil's focus on microbial products, Chile's market is dominated by biochemicals—including pheromones and growth regulators—aimed at enhancing the quality and compliance of its exports.

Argentina - A Balanced and Robust Growth Hub: Argentina's market structure is exemplary, showing balanced development across seed treatment, biostimulants, biofertilizers, and biocontrol. In 2024, its market exceeded $120 million with double-digit growth, and with over 18 million hectares treated with at least one biological product, it demonstrates strong market penetration and maturity.

Macro Tailwinds: What's Driving This Transformation?

The rise of Latin America's biologics market is no accident but the result of a confluence of powerful drivers. For investors, understanding these fundamental factors is crucial:

1. Streamlined Regulatory Pathways: Compared to the lengthy approval cycles in Europe and the US, Latin American countries generally offer more efficient and favorable regulatory policies, allowing innovative products to reach the market faster.

2. Pressing Real-World Needs: The growing challenge of pest and disease resistance is compelling farmers to seek alternatives to conventional chemical pesticides. With their novel modes of action, biologicals are invaluable tools for addressing this challenge.

3. A Deep-Rooted Culture of Innovation: From the early adoption of Rhizobium in soybeans to the large-scale use of bionematicides in row crops today, the region has a proven history of identifying, validating, and commercializing biological innovations at scale.

4. The Future of Technological Convergence: Biologics are increasingly integrated with cutting-edge technologies like precision agriculture, AI, and digital tools. This synergy not only enhances product efficacy but also creates entirely new market spaces and business models.

5. Shifting Global Trade Dynamics: Ongoing international trade frictions are unexpectedly creating new opportunities for Latin America. For instance, some countries are boosting domestic agriculture to reduce reliance on imports, while traditional exports (like Brazilian coffee) are being redirected to new markets, all of which creates new platforms for the application of biologics.

Challenges and the Path to Victory: Staying Clear-Headed Amidst Prosperity

The market boom has inevitably led to fierce competition. In Brazil, the number of companies with at least one registered biological product surged from just eight in 2014 to 53 in 2024, and price wars are already emerging. In this increasingly crowded field, simple product imitation is no longer a viable path.

Future winners must have a clear differentiation strategy—whether through cutting-edge technology, unique formulations, innovative application methods, or disruptive business models. Furthermore, Brazil's forthcoming New Biologics Law will impose stricter, unified quality standards (including for on-farm production). This is both a challenge and an opportunity, as it will clear out low-end competitors and create a healthier competitive landscape for high-quality producers.

Outlook

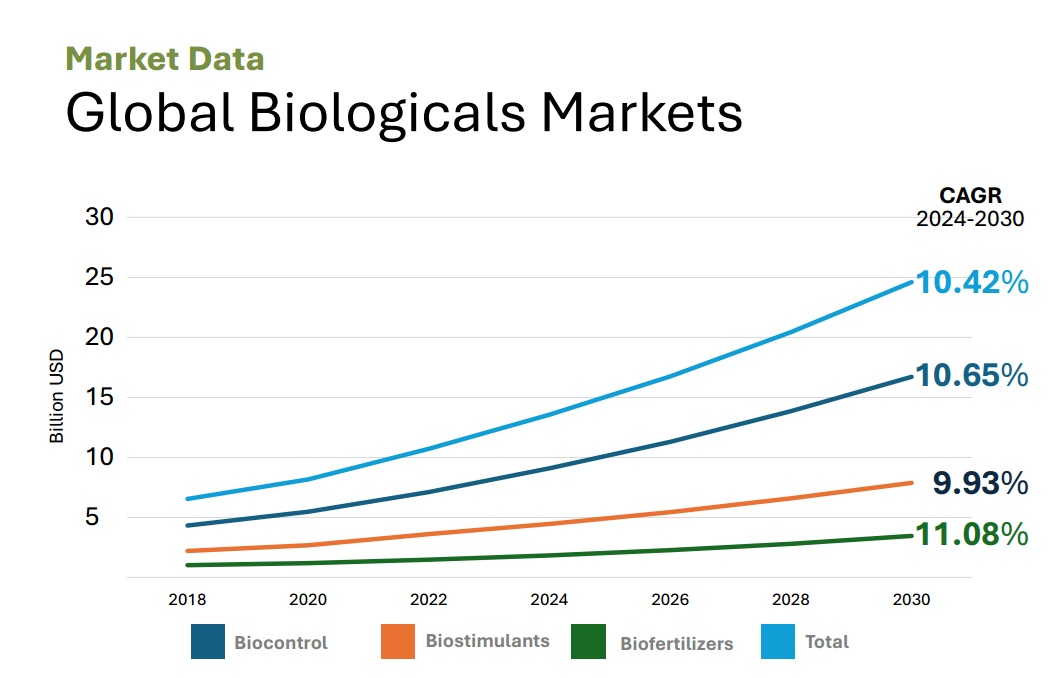

With the global biologics market projected to reach $30 billion by 2030, Latin America, and Brazil in particular, stands at a historic crossroads of opportunity. Despite facing challenges like intensifying competition and policy uncertainties (such as Brazil's 2026 presidential election), its powerful endogenous growth drivers and favorable macroeconomic environment have already secured its position as a leader in the future of sustainable agriculture.