China's Agrochemical "Patent Cliff": An Impending Gold Rush and Shakeout

Over the next five years, China's agrochemical market is set to undergo a profound structural transformation. A wave of core pesticide compound patents held by multinational giants such as Bayer, Syngenta, and BASF will successively expire in China, undoubtedly opening an unprecedented window of opportunity for domestic enterprises. However, beneath this wave, known as the "patent cliff," lie not only gold mines but also hidden reefs.

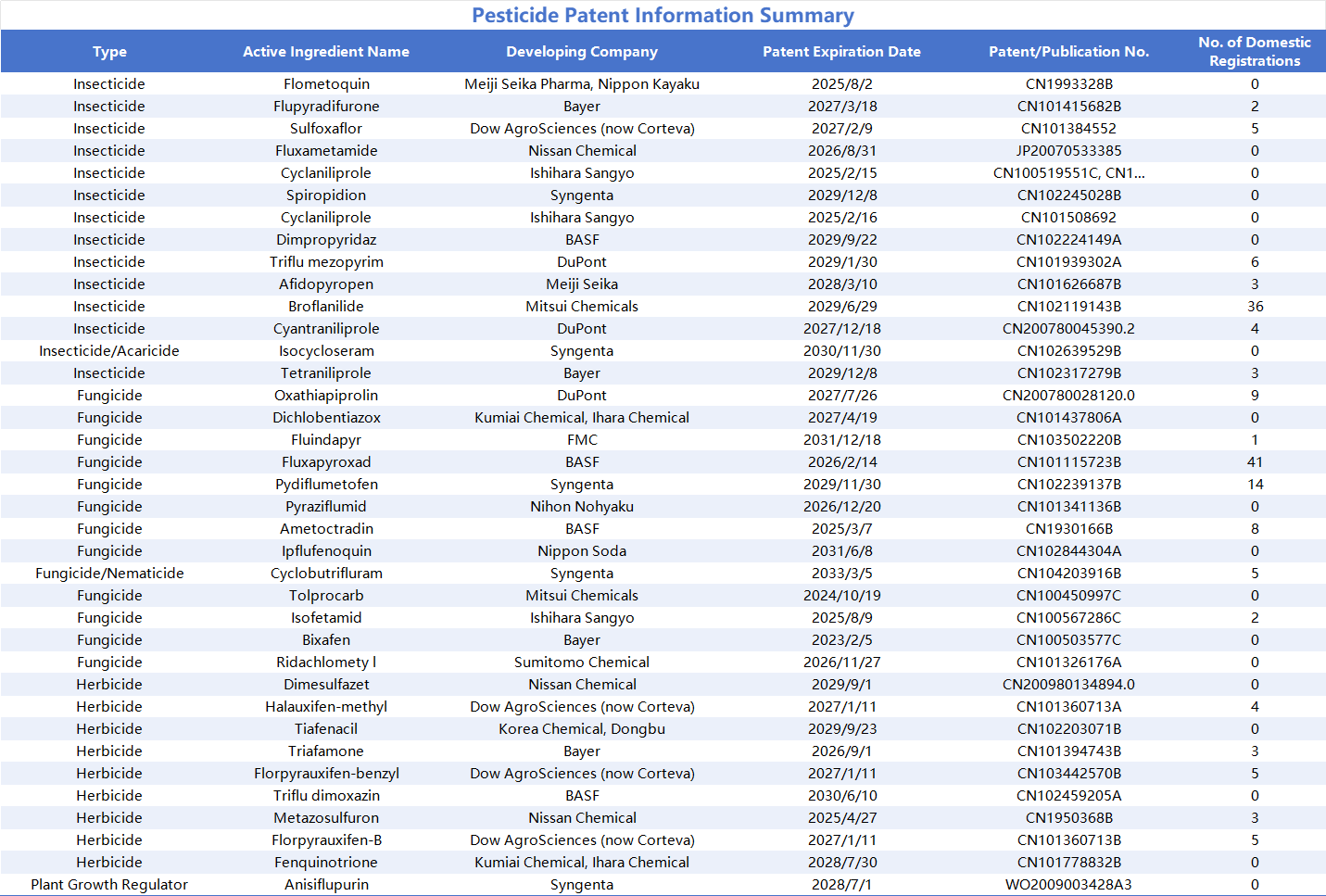

According to statistics, nearly 40 compound patents—spanning insecticides, fungicides, herbicides, and even plant growth regulators—will become invalid in China within the next five years. This impending technical "liberalization" means that domestic companies will have the chance to enter the high-value-added product sector, which has long been fortified by patent barriers.

Among these, the most compelling treasures are the compounds that have not yet been registered in China. Data shows that nearly half (around 18) of these expiring compounds currently have no registration records in the country. This presents a vast blue ocean for companies daring enough to be first-movers. For example:

In the insecticide sector: Compounds like Fluxametamide (developed by Nissan Chemical), Cyclaniliprole (by Ishihara Sangyo), and Isocycloseram (by Syngenta) all represent new mechanisms of action and market potential.

In the fungicide sector: Dichlobentiazox (by Kumiai and Ihara Chemical) and Pyraziflumid (by Nihon Nohyaku) are promising candidates awaiting development by domestic firms.

In herbicides and plant growth regulators: Products like Dimesulfazet (by Nissan Chemical) and Anisiflupurin (by Syngenta) also offer opportunities to fill market gaps.

Meanwhile, for the popular products already registered in China, patent expiration signals a complete reshaping of the competitive landscape. For instance, after losing patent protection, compounds like DuPont's Cyantraniliprole and Afidopyropen, as well as Mitsui Chemicals' Broflanilide (which already has 36 domestic registrations), will inevitably trigger fiercer market competition, leading to more rational pricing and ultimately benefiting growers.

However, behind the opportunities lie equally stern challenges. Domestic companies must conduct calm and prudent strategic assessments when planning to enter the post-patent market, avoiding the trap of blindly following trends. This includes overcoming technical barriers: the expiration of a compound patent only solves the "can it be made?" question; "can it be made well?" depends entirely on a company's technical capabilities. The originator's peripheral patents on production processes, crystalline forms, and adjuvant formulations can still pose significant hurdles, requiring strong R&D and process optimization skills.

Another challenge is discerning market potential. Not all patented compounds have a large market capacity. Some may target niche crops or specific pests and diseases, resulting in a low market ceiling. Furthermore, whether a product offers a significant advantage over existing mainstream alternatives and how easily it can be substituted are key factors determining its commercial value.

The investment of capital and time is also a major consideration. The journey from completing process development and conducting field trials to finally obtaining registration approval from the Ministry of Agriculture and Rural Affairs is a long and costly process. Companies must assess their financial strength and risk tolerance to determine if they can support a product through its entire lifecycle.

Prudence in intellectual property is also crucial. Beyond the core compound patent, originators often build a fortress of peripheral patents covering manufacturing methods, intermediates, and formulations. Companies must conduct thorough IP due diligence before launching a project to avoid potential infringement risks.

Facing this feast of patent expirations, Chinese agrochemical enterprises need a cool head and a precise strategy. The key to success is not to chase every seemingly attractive product, but to select targets that are highly aligned with their own technical platforms, market channels, and development strategies.

Companies should establish a scientific evaluation system to thoroughly screen candidate products from the four dimensions of technical feasibility, market prospects, return on investment, and IP risks. Ultimately, only those enterprises that can perfectly integrate technological innovation with market strategy and formulate a scientific and rational development path will be able to seize the opportunity in this market reshuffle, turning the "patent cliff" into a "launchpad" for their own growth and securing a position in the new competitive landscape.