Pesticide Market Weekly Report: Prices of 12 Bulk Drugs Drop, Indoxacarb Falls by $2,809/ton – Will It Keep Falling?

Recently, the overall atmosphere of the pesticide market has been relatively sluggish, with few inquiries and transactions. The market is currently in a consolidation phase. However, weak stability does not mean no changes – the price trends of different pesticide varieties have begun to diverge: some maintain stable prices due to low inventory and limited production; some linger at low levels due to oversupply and weak demand; a small number of varieties that rose in price earlier have also started to retrace as demand fails to keep up.

Let’s first focus on the bulk drug varieties that saw price declines last week, then discuss the future trend of the market.

I. Prices of 12 Bulk Drug Varieties Dropped!

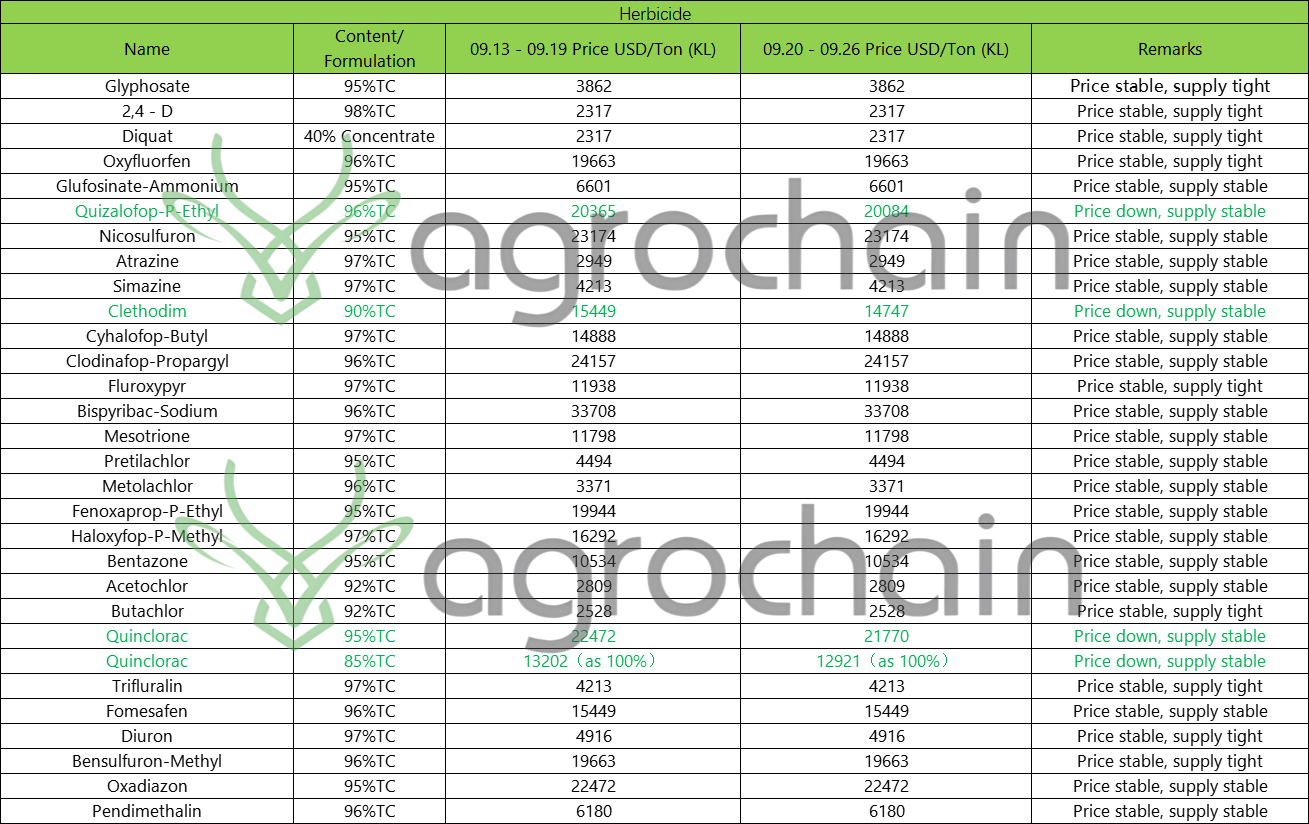

Last week, 12 pesticide bulk drug varieties recorded explicit price cuts, covering three major categories: herbicides, insecticides, and fungicides. Some varieties even saw significant declines. Here is a breakdown by category:

1. Herbicides

96% Quizalofop-P-ethyl: Down by $281 per ton, currently standing at $20,084/ton;

90% Clethodim: With the largest drop, falling by $702 per ton, the latest price is $14,747/ton;

95% Quinclorac: Down by $702 per ton, dropping to $21,769/ton;

85% Quinclorac: Fell by $281 per ton, currently at $12,921/ton.

The price declines of these herbicides are mainly due to the fact that the current period is not the critical phase for weeding, so downstream demand has not picked up. Meanwhile, market supply remains relatively sufficient, making it difficult to sustain prices.

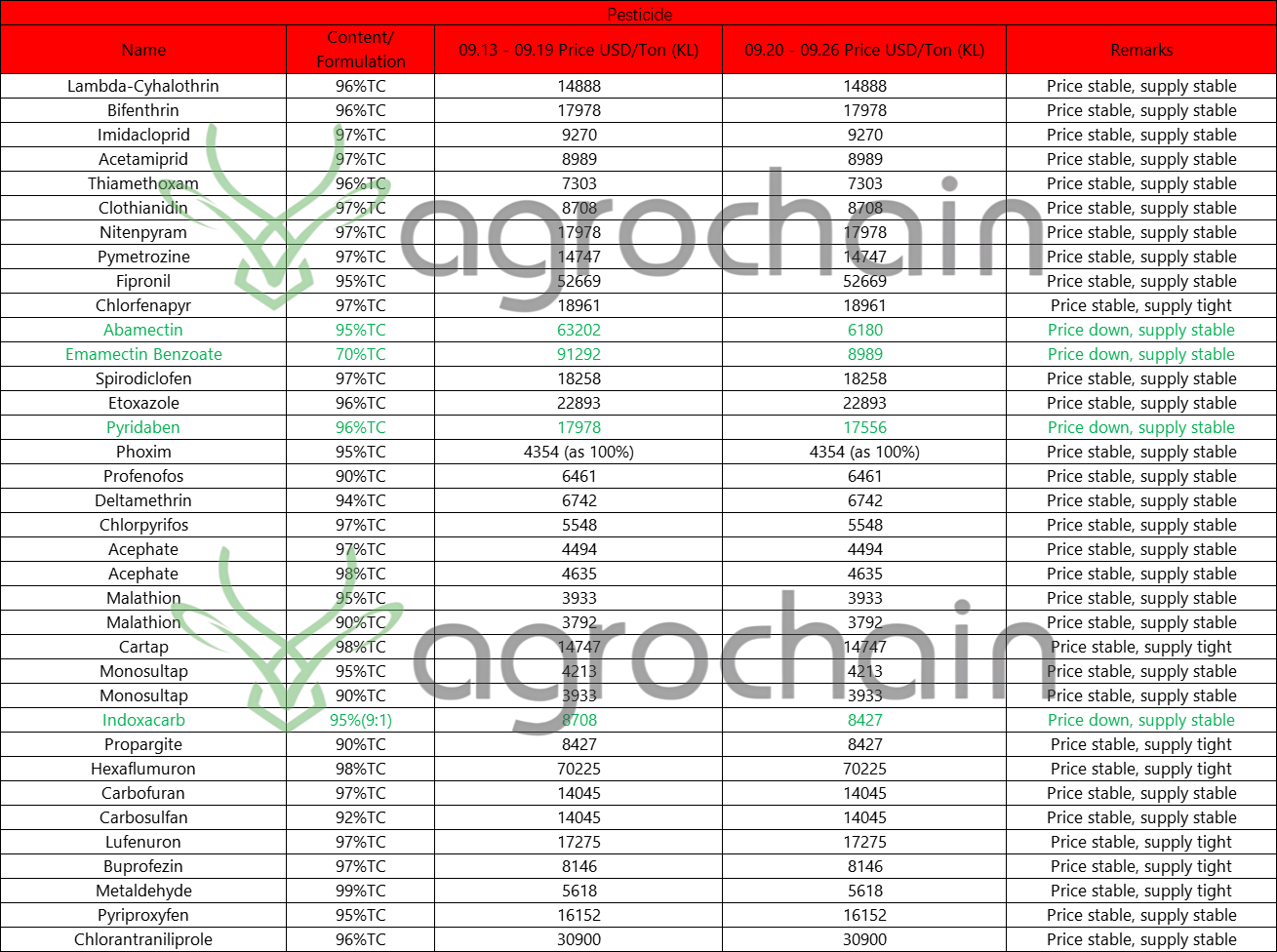

2. Insecticides

95% Abamectin Technical Powder: Down by $1,404 per ton, now at $61,798/ton;

70% Emamectin Benzoate: Also fell by $1,404 per ton, the latest price is $90,028/ton;

96% Pyridaben: Down by $421 per ton, dropping to $17,556/ton;

95% Indoxacarb: The insecticide with the largest decline this time, falling by $2,809 per ton directly, currently at $84,242/ton.

Weak demand is the main driver behind the price drops of insecticides. Currently, crop diseases and pests are relatively mild in most regions, so farmers have low willingness to purchase, and distributors also dare not stock up in large quantities. The market is in a state of oversupply, forcing prices to decline.

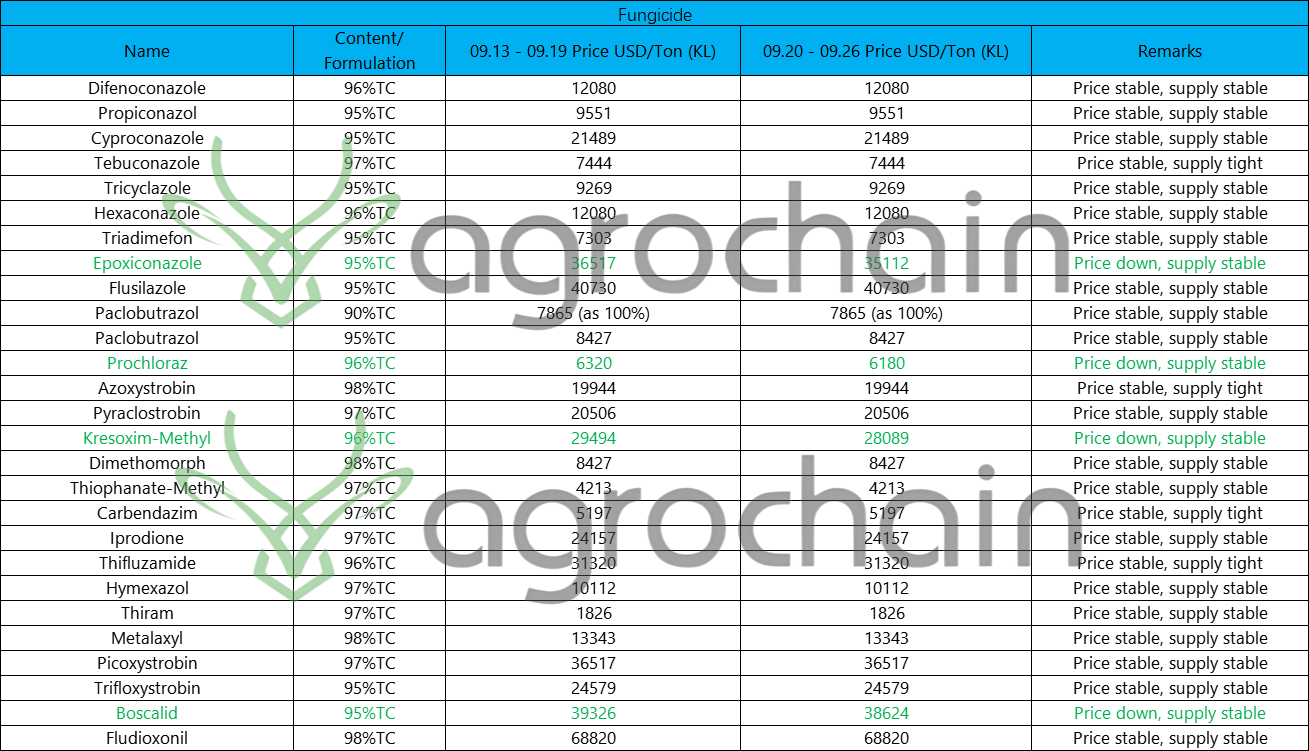

3. Fungicides

95% Epoxiconazole: Down by $1,404 per ton, now at $35,111/ton;

96% Prochloraz: With a relatively small drop, falling by $140 per ton, the latest price is $6,179/ton;

96% Kresoxim-methyl: Fell by $1,404 per ton, dropping to $28,089/ton;

95% Boscalid: Down by $702 per ton, currently at $38,624/ton.

The situation of fungicides is similar to that of insecticides. The incidence of diseases and pests is low, so there is no support from the demand side. Some varieties even have inventory backlogs, leading to price adjustments in line with market conditions.

II. Why Does the Market "Diverge"?

For the same pesticide sector, why do some varieties maintain stable prices while others have to cut prices? There are two core reasons: inventory and demand.

Varieties with stable prices: Most of them have fully digested their early inventory, leaving little stock in warehouses. In addition, manufacturers have low operating rates, so the supply of new goods cannot keep up. The market is in a state of "shortage of goods", and even if demand is average, prices can remain stable.

Varieties with falling prices: Either the market supply is too sufficient, or downstream demand is extremely weak. Some varieties even rose too sharply in the early stage and now have to retrace and cut prices as demand fails to provide support.

However, overall, the prices of most pesticide varieties remain stable. Only a small number of varieties fluctuate under the influence of supply and demand, and the fluctuation range is not large.

III. What Will Happen to the Market in the Later Stage?

Many people are concerned: Will pesticide prices continue to fall in the future? When will the market recover? Based on the current market situation, we can make the following predictions:

Short-term focus on "sideways price stabilization": Currently, both domestic and international markets are in the off-season for pesticide demand. Farmers and distributors have low willingness to purchase, and market transactions are inactive. Therefore, in the short term, the prices of most mainstream pesticide varieties will remain stable without sharp fluctuations.

A small number of varieties may "continue to decline": For varieties with particularly weak current demand and relatively high inventory – such as some insecticides and herbicides – if demand still fails to pick up in the follow-up, prices may drop further.

Room for price increases? No motivation for now: Although the inventory of many pesticides is already low, "shortage of goods" does not equal "ability to increase prices" – the key still lies in demand. As long as downstream purchases do not follow up, prices cannot rise even with low inventory.

Therefore, in the short term, the pesticide market will most likely remain in a "weakly stable" state. A significant price increase may only occur when the subsequent peak demand season arrives and farmers start purchasing in batches.

For distributors and farmers, it is advisable to pay more attention to market dynamics at present: Those who intend to stock up can compare varieties with price cuts and reserve small quantities of cost-effective ones in advance; those who plan to sell do not need to rush to offload goods at low prices, as prices may have room for a slight rebound when demand recovers in the follow-up.