Brazil's Agricultural Enterprises See 31.7% Surge in Judicial Restructuring Applications in Q2 2025: Pillar Industry Faces Multiple Pressures

In the second quarter of 2025, a worrying signal emerged from Brazil's agricultural sector: the number of judicial restructuring applications by agricultural enterprises rose significantly, hitting a new high for the same period. This data not only reflects the operational difficulties of individual farmers but also reveals that the agricultural industry, a core pillar of Brazil's economy, is facing overall financial pressure. The in-depth challenges behind its structural changes deserve close attention.

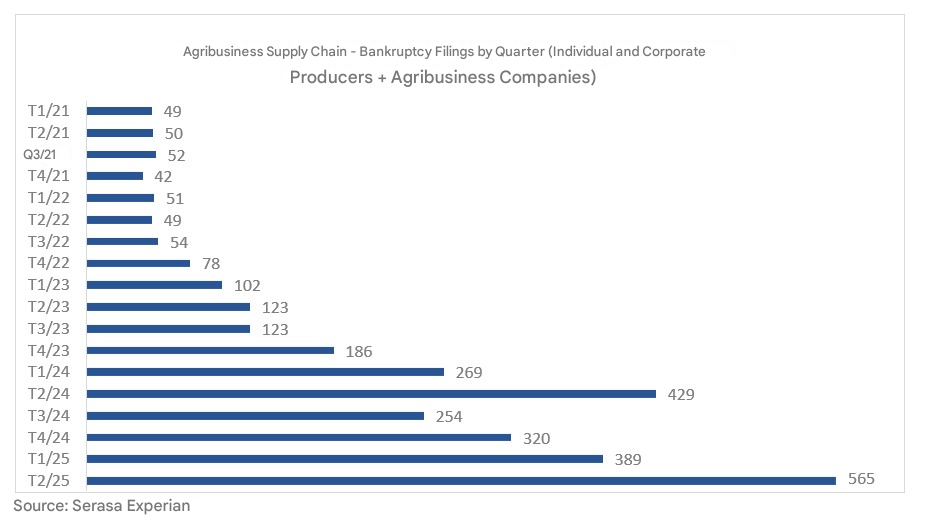

Statistics released by Serasa Experian, a Brazilian credit analysis data technology company, show that a total of 565 judicial recovery applications were submitted across Brazil's entire agricultural industry chain in the second quarter of 2025, representing a substantial 31.7% increase compared to the 429 applications in the same period of 2024. Notably, the statistics cover all links of the agricultural industry, including individual farmers engaged in basic production, large-scale enterprise-based agricultural operators, and related enterprises providing supporting services for agricultural production. This indicates that the financial distress in Brazil's agricultural sector has spread throughout the entire chain.

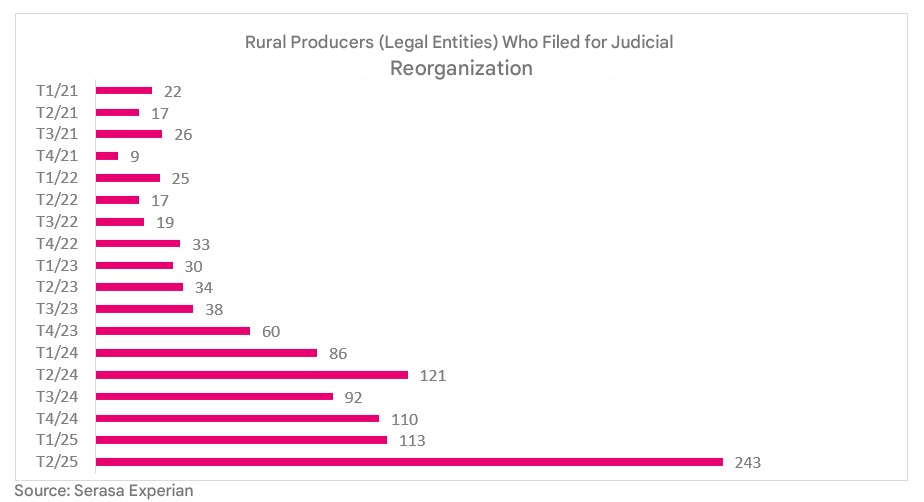

The judicial restructuring application data for this quarter showed a key structural shift - enterprise-based producers (legal entities) submitted more applications than individual natural persons for the first time, with a doubling of the number. Specifically, legal entities filed 243 judicial restructuring applications, a growth rate of over 100% compared to 121 applications in the same period of 2024. This change has broken the previous pattern where individual farmers were the main applicants. What is particularly thought-provoking is that enterprise entities, which are generally larger in scale, have more sound organizational structures, and theoretically stronger risk resistance capabilities, have now become the main force of judicial restructuring applications. In response to this, Serasa Experian stated that it is conducting further research to determine whether this phenomenon is caused by the concentrated release of previously accumulated application demands or a fundamental change in the risk characteristics of agricultural operators.

From the perspective of specific industrial sectors, Brazil's two major agricultural pillar industries - soybean cultivation and animal husbandry - are facing the most severe challenges. Among the judicial restructuring applications by enterprise-based producers, the soybean cultivation sector ranked first with 192 applications, accounting for nearly 80% of the total applications by legal entities; animal husbandry ranked second with 26 applications. As core categories of Brazil's agricultural exports, the operational difficulties of soybeans and animal husbandry are directly related to the overall competitiveness of Brazil's agriculture, and the pressures they face also reflect the profound impact of global agricultural product market fluctuations on Brazil's agriculture.

In addition to agricultural production entities, the number of judicial restructuring applications by related enterprises providing supporting services for the agricultural industrial chain also rose simultaneously, hitting a recent high. Data shows that agricultural-related enterprises submitted 102 applications, a continuous increase compared to 94 applications in the same period of 2024. From the perspective of sub-sectors, the agricultural product processing sector is under the most prominent pressure, ranking first with 32 applications, covering multiple key processing categories such as soybean oil, soybean meal, sugar, ethanol, and dairy products; primary processing industries such as wood processing and grain handling followed closely with 22 applications; agricultural bulk traders also submitted 18 applications, indicating that the entire chain from production and processing to trade and circulation has been impacted.

Data from Serasa Experian's agricultural credit scoring system provides side evidence for this phenomenon: the credit scores of enterprises that eventually filed for bankruptcy had been consistently lower than the industry average for three years before the official application. This indicates that the financial distress of enterprises is not a short-term sudden event but the result of long-term accumulation. The company emphasized that the research data released this time is derived from monthly statistics of courts in various Brazilian states, covering agricultural producers of all sizes and officially registered agricultural economic activity enterprises, ensuring the comprehensiveness and authority of the data.

Comprehensive analysis shows that the financial distress faced by Brazil's agricultural integrated enterprises is the result of the superposition of multiple factors. Firstly, the violent fluctuations in commodity prices have made the profit expectations of agricultural production extremely unstable. As an important global agricultural exporter, Brazil is highly sensitive to international market prices, and falling prices have directly squeezed the profit margins of enterprises. Secondly, the continuous rise in the cost of production materials has further intensified the financial pressure on enterprises. The price increases of key production materials such as chemical fertilizers, pesticides, and feed have significantly increased the input costs of agricultural production. In addition, production uncertainties caused by climate change have also become an important incentive. The frequent occurrence of extreme weather events has led to reduced crop yields and increased losses in animal husbandry, further weakening the profitability and solvency of agricultural enterprises.

As an important global exporter of soybeans, coffee, and sugar, the healthy development of Brazil's agriculture is not only related to its domestic economic stability but also plays a pivotal role in the global agricultural supply chain. The surge in judicial restructuring applications has sounded an alarm for Brazil's agriculture. How to stabilize the prices of production materials through policy regulation, enhance the risk resistance capabilities of agricultural enterprises, and address the production challenges brought by climate change will become important issues that the Brazilian government and agricultural sector urgently need to solve.