Brazil's fertilizer imports have reached a historic high, with an explosive growth in the proportion from China.

1. Analysis of Historical and Current Import Volumes (January–July 2025)

In the first seven months of 2025, Brazil's fertilizer imports reached a historic high. This trend is not a sign of unlimited market confidence but rather a proactive, risk-averse procurement strategy.

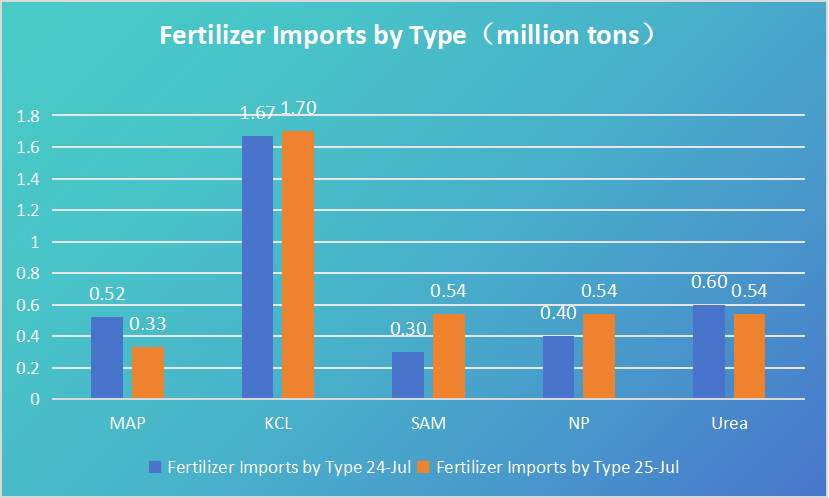

Data shows that in July 2025, Brazil's fertilizer imports hit 4.79 million tons, setting a new record for the highest single-month import volume of the year. This represents a 15.6% increase from June and a 7.1% increase from the same period in 2024, marking a "historic high for a single month of July." For the year to date, from January to July 2025, Brazil's total fertilizer imports reached 24.20 million tons, an 8.8% increase compared to the same period in 2024. This figure surpasses the previous record of 23.67 million tons set in 2022 by 2.2%. To put this trend into perspective, Brazil's total fertilizer imports for the full year of 2024 were 44.34 million tons, which was already a new historical record.

2. The Core Driver: "Front-loading" Purchases to Counter Supply Chain Concerns

The market's behavior is best interpreted as "front-loading" purchases, a preventive measure aimed at mitigating risk. Importers and distributors are actively building inventory to hedge against potential future supply disruptions and price spikes, a clear reflection of market anxiety.

This procurement pattern stems directly from concerns that geopolitical conflicts could lead to supply interruptions. After the uncertainty brought by the conflict between Israel and Iran in June, the market faced new pressure in July due to an escalation in the U.S.-led trade war. The risk of the U.S. imposing new tariffs on countries that maintain trade relations with Russia, including Brazil, has further heightened fears of supply disruptions. This market sentiment has prompted producers to seek early purchases to secure the necessary supplies for crop production.

Analysis shows that the record import volumes are not merely a sign of economic prosperity or rising demand but are an "embodiment of fear." It is a risk-hedging strategy where companies are pre-stocking to avoid being caught off guard by potential future supply shortages. This transforms a seemingly positive data point (record import volume) into a signal of market anxiety and vulnerability. Although the farmer's terms of trade (the ratio of agricultural product prices to input prices) tend to worsen, fertilizer purchases are likely to continue because a drop in productivity due to a shortage of inputs is more severe than the impact of increased expenditure.

3. Shifts in the Global Supply Chain

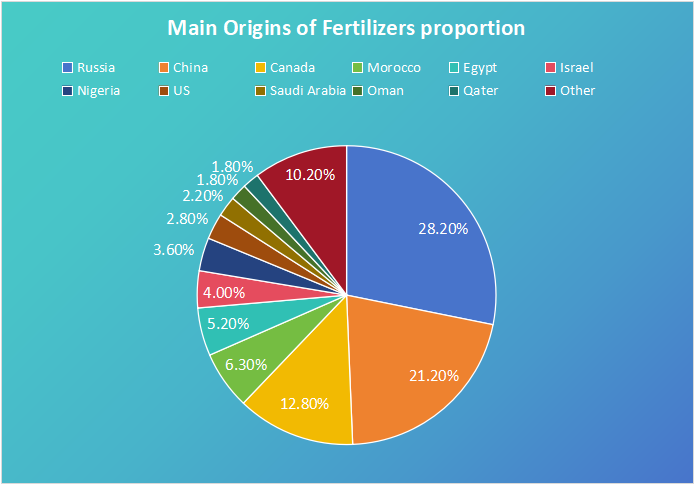

Despite Western sanctions, Russia remains Brazil's largest single fertilizer supplier. This demonstrates the limitations of sanctions when it comes to key commodities, especially when a major buyer is willing to bypass political pressure.

From January to July 2025, Russia continued to be the largest supplier, shipping 6.88 million tons and accounting for 28.2% of Brazil's total fertilizer imports, an 18% increase from the previous year. Meanwhile, the Russian government is also controlling fertilizer supply through an export quota system, which has been extended until November 30, 2025.

The significant growth in China's fertilizer exports to Brazil is the most noteworthy development in the global supply chain. This signals a strategic deepening of the China-Brazil agricultural partnership, with both countries using commodity trade as a tool for geopolitical and economic influence.

From January to July 2025, China became Brazil's second-largest fertilizer supplier, providing 5.14 million tons, which accounts for 21.2% of total imports—a substantial year-on-year increase of 75.7%. China has also formulated its own fertilizer export policies. The Chinese government has set the total import tariff quota for fertilizers in 2025 at 13.65 million tons, and total exports are expected to return to historical levels of approximately 5 million tons before the export controls of 2022. This growth is complemented by the existing trade relationship between China and Brazil. China is the largest buyer of major agricultural products from Brazil, with 73% of its soybean imports originating from Brazil.

4. Fertilizer Demand and Price Forecast for the Second Half of 2025

Due to seasonal factors and restocking needs, fertilizer demand is expected to remain strong in the second half of 2025. Price volatility will persist, influenced by global supply dynamics and geopolitical events. DATAGRO predicts that 2025 is on track to set new records in both volume and value. Nutrien, the world's largest potash producer, also expects Brazil's demand to remain stable in the third quarter.

Brazil's agricultural sector is being drawn into a new, more volatile equilibrium. The import surge of 2025 is a preview of this "new normal." Price volatility and import surges are not temporary anomalies but the result of a structural shift in global trade. Demand is fundamentally strong, supply sources are shifting, and geopolitical risks are persistent. This new equilibrium is characterized by increased risk but also strategic adaptation. Brazil's shift toward new suppliers and investment in domestic production are not optional but necessary responses to maintain its position as a global food exporter. Future developments will depend on the extent to which Brazil successfully executes this strategic transition.