A Deep Dive into China's Mango Pesticide Market: Structural Imbalances and Potential Risks Beneath a Prosperous Facade

As the world's second-largest mango producer, China's mango industry boasts increasing economic value, with annual production now exceeding 4 million tons. However, the pesticide registration system that supports this massive industry, despite its seemingly prosperous surface, reveals multiple challenges, including severe structural imbalances, growing product homogenization, and rising resistance risks.

General Overview: An Imbalanced Market Dominated by Fungicides

According to the latest statistics, a total of 199 pesticide products specifically for use on mangoes are currently within their valid registration period in China. While this appears to be a relatively rich pool of choices, a deeper analysis of its composition makes the structural problems immediately clear.

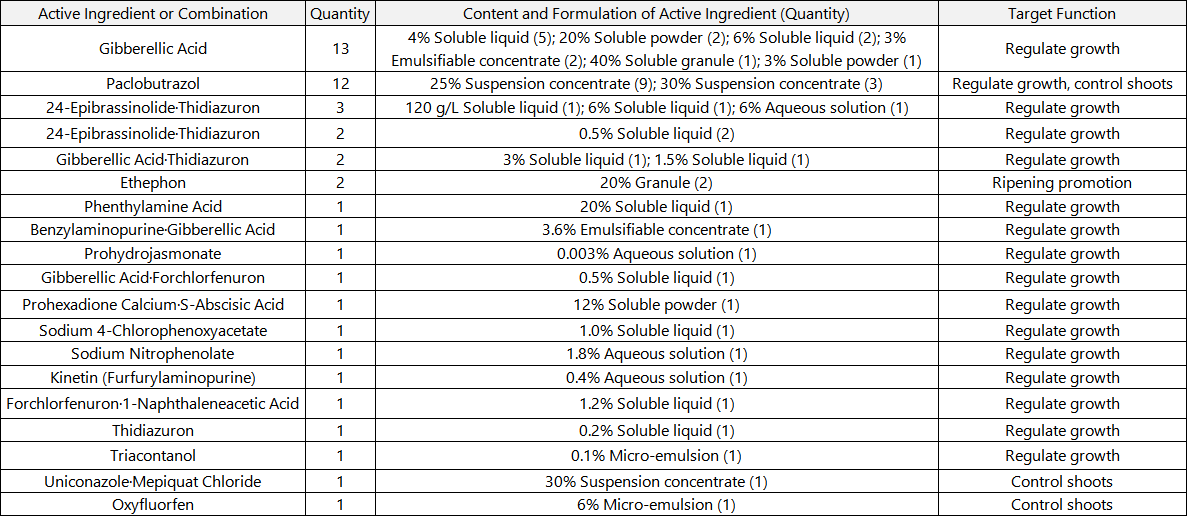

First, the product categories are extremely imbalanced. Fungicides dominate with 107 registration certificates, accounting for over half the market (53.8%). Insecticides (22.1%) and plant growth regulators (23.6%) are comparable in number, while herbicides are a virtual blank slate, with only one registered product. This is far from adequate to meet the complex weed management needs of mango orchards. This registration pattern, which heavily prioritizes disease control over insect prevention and almost entirely neglects weed management, does not align with the complex, combined threats from pests, diseases, and weeds that mangoes face throughout their growth cycle.

Second, formulations and application methods are highly concentrated. Among the 14 registered formulation types, Suspension Concentrate (SC) is the undisputed leader (31.1%), while spraying (92.0%) is the absolute mainstream application method. Although the majority of products have low toxicity (87.9% are classified as low-toxicity), indicating a trend towards safer options, the overall lack of diversity remains a significant limitation.

Core Issue 1: High Homogenization and Over-Concentration of Target Pests

The most critical issue in the current mango pesticide market is the high degree of product homogenization. For both fungicides and insecticides, the market relies heavily on a handful of "star" active ingredients.

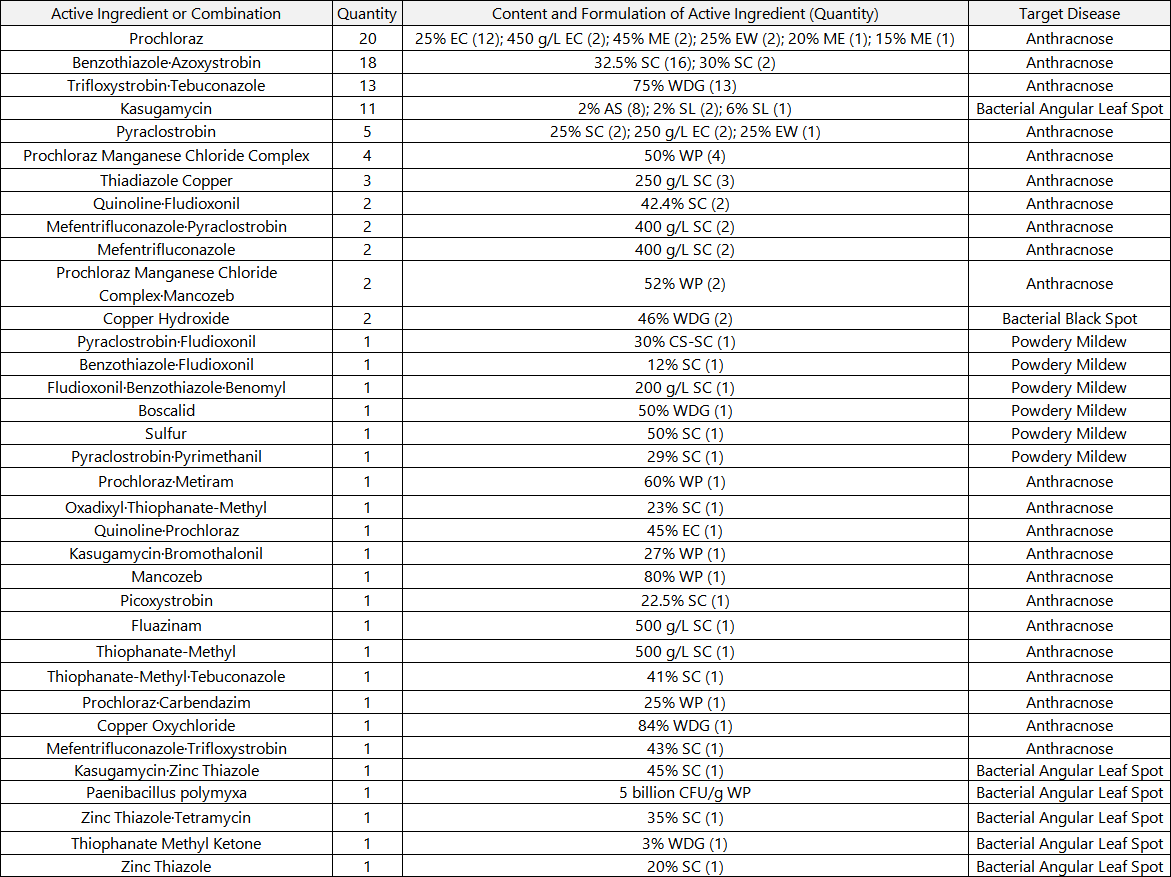

In Fungicides: Over 62% of products are concentrated on just a few active ingredients or their combinations, such as prochloraz, difenoconazole + azoxystrobin, and trifloxystrobin + tebuconazole. Products containing prochloraz alone account for 26.2% of all fungicides. This homogenization leads directly to a singular focus on treatment targets, with 77.6% of fungicides clustered around controlling anthracnose, leaving a lack of effective registered agents for other important diseases like gummosis and scab.

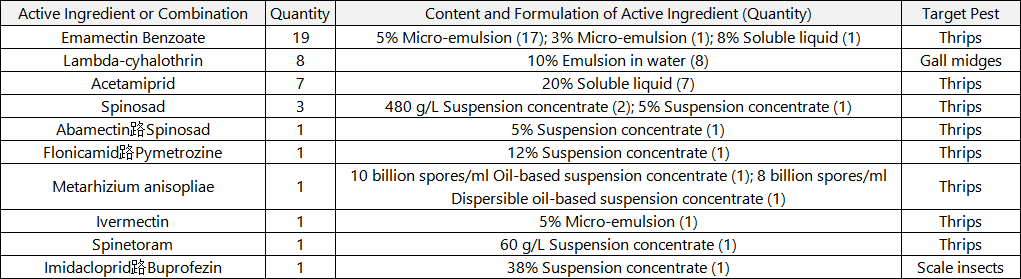

In Insecticides: The situation is even more severe. The single-agent emamectin benzoate accounts for nearly half of all registered insecticides (40.9%). Combined with lambda-cyhalothrin and acetamiprid, the top three ingredients comprise 84.1% of all insecticide products. Correspondingly, 79.5% of insecticides are registered for the control of thrips, leaving farmers with virtually no specialized options for other pests that cause serious damage, such as the mango leaf-cutting weevil and long-horned beetles.

Core Issue 2: Lagging Development of Combination Products and Grave Concerns for Resistance Management

Although combination (pre-mix) formulations offer significant advantages in broadening the control spectrum and delaying resistance, their potential in the mango pesticide market is far from being realized.

Among all registered products, single-agent formulations account for a staggering 67.3%, while binary combinations make up just 32.7%, with no ternary or more complex combinations to be found. More concerning is that insecticides represent only 4.6% of these few combination products. This means the strategy for controlling key pests like thrips is still reliant on the "brute force" of single-agent products, lacking combination solutions with ingredients from different modes of action (such as neonicotinoids or pyrethroids). This undoubtedly paves the way for the rapid development of resistant pest populations.

In fact, the resistance issue is already emerging. Reports indicate that mango anthracnose and stem-end rot pathogens have developed varying degrees of resistance to commonly used agents like prochloraz, carbendazim, and pyraclostrobin. If the product structure is not optimized, the long-term, high-frequency use of single-agent pesticides will only exacerbate the problem.

Future Outlook: Structural Optimization and Innovation are Key to a Breakthrough

Overall, China's mango pesticide market faces a dilemma of "having many choices in appearance, but few in reality." An irrational product structure, severe homogenization, and a lack of combination formulations together form a bottleneck restricting the healthy development of the industry. The path to a breakthrough lies in:

Guiding Structural Optimization: Encouraging companies to develop and register pesticide products for a wider range of targets (especially for currently neglected pests and diseases), particularly to fill the significant gap in herbicides and broad-spectrum insecticides.

Promoting Combination Innovation: Vigorously supporting the development of multi-site combination products, especially for insecticides, to scientifically slow the onset of resistance and improve integrated pest management outcomes.

Strengthening Resistance Monitoring: Establishing a systematic resistance monitoring network to provide data-driven support for scientific pesticide use and product development, thereby avoiding the repetition of past mistakes.

Only by making structural adjustments at the registration source and encouraging differentiated and innovative product development can China provide more comprehensive, efficient, and sustainable crop protection solutions for its vital mango industry.