New Trends in the Seed Treatment Market for H1 2025: Focusing on Peanuts and Wheat, Uncovering Opportunities in Five Major Crops

Seeds are the "chips" of agriculture, and seed treatment agents are the key technology that outfits these "chips" with high-tech "armor." By scientifically formulating fungicides, insecticides, plant growth regulators, and film-forming agents, seed treatments provide a protective yet permeable coating for seeds. This technology not only prevents pests and diseases from the source but also significantly enhances crop stress resistance and final yield. It is a vital pathway to standardizing seed quality, reducing pesticide use, and protecting the agricultural ecosystem.

Market Trends in H1 2025: Combination Products Dominate, Dryland Crops Reign Supreme

As of the first half of 2025, 61 new seed treatment product registrations have been added in China, revealing clear market trends.

Firstly, combination formulations are the absolute mainstream. Among the new registrations, single-ingredient products accounted for only 10, while combination products—blending insecticides, fungicides, and growth regulators—numbered a staggering 51. The "insecticide + fungicide" combination was by far the most common, directly reflecting the reality of concurrent pest and disease pressures in agricultural production and highlighting the urgent market demand for "all-in-one" solutions that save labor and increase efficiency.

Secondly, suspension concentrates are highly favored. In terms of formulation types, Flowable Concentrate for Seed Treatment (FS) dominated with 46 registrations, far surpassing Water Dispersible Powder for Seed Treatment (DS) and Soluble Concentrate for Seed Treatment (SL). This indicates that its superior film-forming properties, stability, and ease of use have made it the top choice for developers.

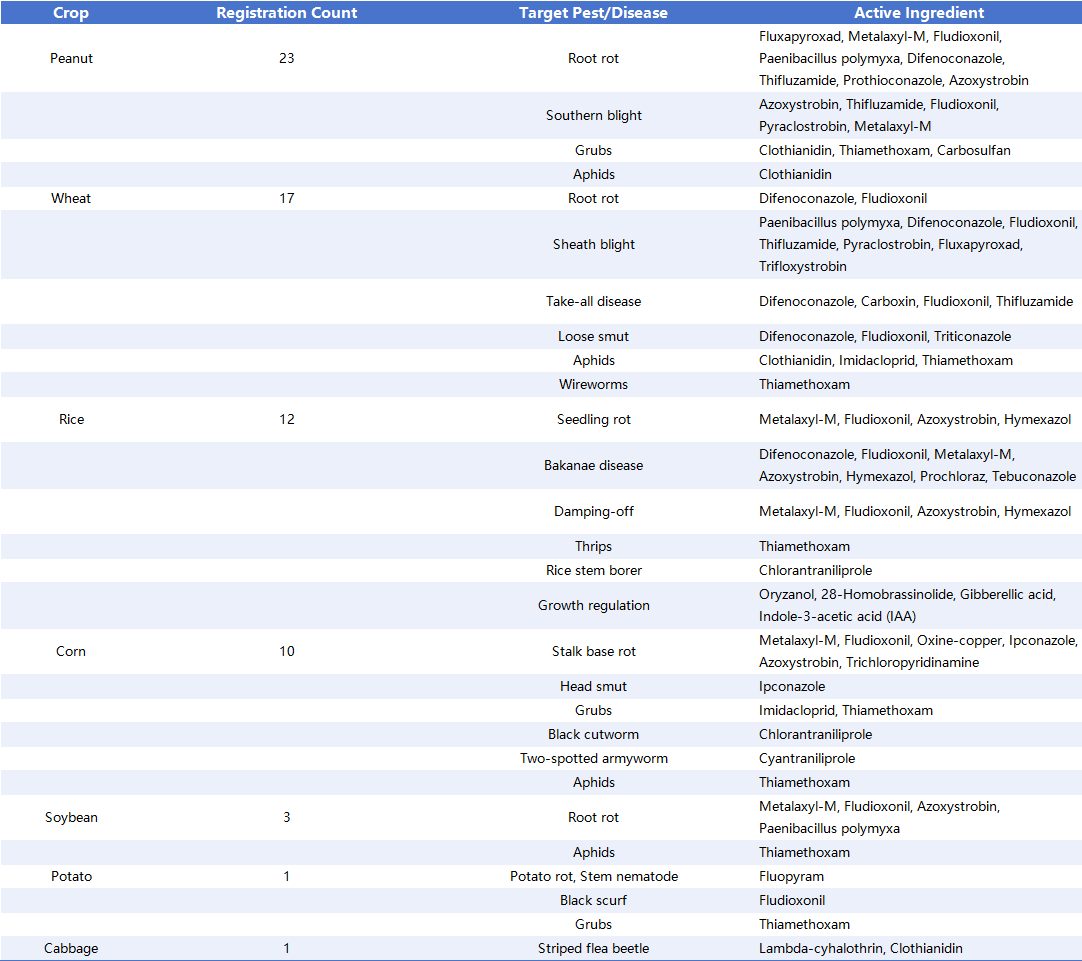

Furthermore, dryland crops are a registration hotspot. Looking at the registered crops, peanuts (23) and wheat (17) lead significantly, followed by rice (12), corn (10), and soybeans (3). The total number of registered products for dryland crops far exceeds that for paddy fields, underscoring the immense market demand for dryland seed treatments, with the peanut and wheat markets deserving particular attention.

Analysis of Five Major Crops: Opportunities and Challenges Coexist

Peanuts: A High-Standard Market Where Quality is King

The market for peanut seed treatments has clear and stringent demands. Its target pests and diseases are primarily focused on root rot, grubs, and aphids. Additionally, southern blight, which has become more severe in recent years, is an emerging registration hotspot. Farmers have very specific needs, such as effective control of subterranean pests like grubs and prevention of seed rot during low-temperature spring sowing. This has established the peanut seed treatment market as a high-quality, high-barrier sector where low-quality products struggle to survive.

Wheat: Massive Volume, Intense Competition

The wheat seed treatment market mainly targets diseases like take-all, loose smut, and root rot, as well as pests such as aphids and wireworms. Due to the high tolerance of wheat seeds and large sowing quantities, the requirements for germination rates are less sensitive than for peanuts and corn. This results in a relatively low technical barrier, attracting numerous agrochemical companies and leading to severe product homogenization and white-hot market competition.

Corn: A New Threat in a Traditional Market

The registered targets for corn seed treatments still revolve around traditional issues like head smut, stalk and base rot, and pests such as grubs and wireworms. However, an undeniable trend is the increasing severity of the fall armyworm infestation in recent years. Despite this, there are very few registered seed treatment products that can effectively control this pest, indicating a significant market gap.

Soybeans: Soaring Demand, Severe Supply Shortage

As one of the most significant diseases in soybean production, root rot is the core target for soybean seed treatments. With the expansion of national soybean acreage and the promotion of soybean-corn intercropping systems, the demand for soybean seed treatments is surging at an unprecedented rate. In stark contrast, the number of registered products remains scarce and is far from meeting the urgent needs of agricultural production, presenting a vast "blue ocean" market with enormous potential.

Rice: High Technical Requirements, Niche Market

The rice market demands a higher level of technical expertise for seed treatments due to its diverse planting methods (direct seeding, seedling transplanting, etc.) and significant variations in climate and pest types between the north and south. Registered targets primarily include seedling diseases like bakanae disease, sheath blight, and seedling rot, as well as pests like thrips and planthoppers. This market tends to be more regionalized and specialized.

In summary, the seed treatment market landscape for the first half of 2025 is clear. It features intense competition in mature markets like peanuts and wheat, while also exposing significant opportunities in a market with emerging threats like corn and, especially, in the underserved soybean market. Companies should closely follow market demands, strengthen their traditional advantages, and proactively address new threats and supply gaps to win the future through technological innovation.