US-India Pesticide Trade Landscape Faces Drastic Changes: Challenges and Transformation Under High Tariffs

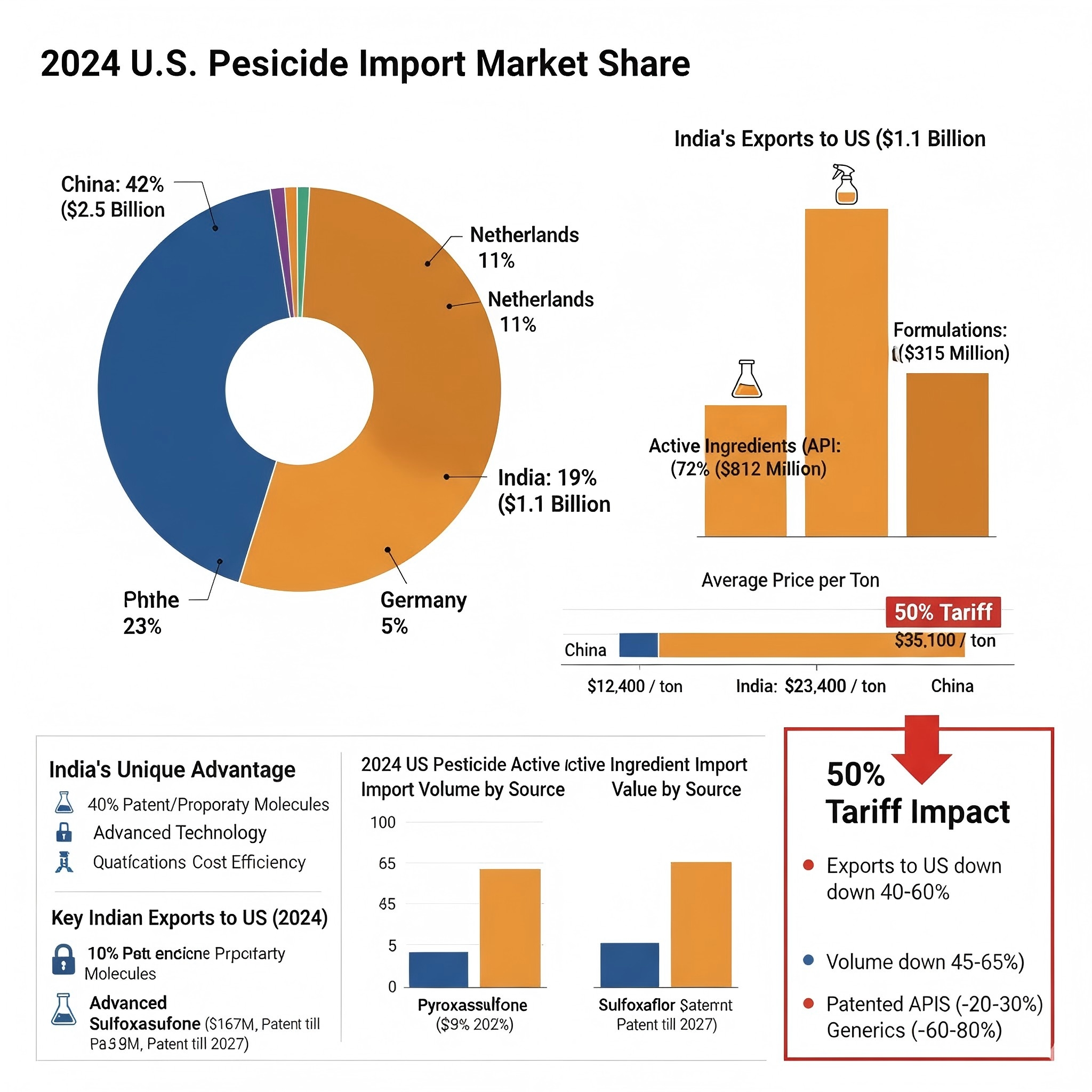

Effective August 27, the United States will impose additional punitive tariffs on all consumer and warehouse goods imported from India, bringing the total tariff rate to 50%. This measure builds upon the existing 25% "reciprocal tariff" previously applied to Indian goods (originally set to take effect on August 1, 2025). The latest 25% punitive tariff is a response to India's continued purchase of Russian oil. As the world's second-largest pesticide market, the US pesticide market reached $10.7 billion in 2023. Imports accounted for $5.9 billion of this total, with India being a significant supplier, holding a 19% market share valued at approximately $1.1 billion. Facing a 50% tariff barrier, the Indian pesticide industry is confronting unprecedented challenges.

India's Significant Role in the US Pesticide Market

In the 2024 US pesticide import market, India plays a crucial role. China leads with a 42% market share and $2.5 billion in exports, followed closely by India, which accounts for 19% of the market. In contrast, traditional pesticide powerhouses like the Netherlands and Germany hold only 11% and 5% respectively.

From a trade structure perspective, out of India's total $1.1 billion in pesticide exports to the US, active ingredients (technical products) dominate, valued at $812 million, representing 72%. Formulated products account for $315 million, or 28%. This export structure, primarily focused on active ingredients, highlights India's important position in the global pesticide supply chain.

Notably, India's pesticide exports demonstrate a differentiated competitive landscape compared to China. China primarily exports high-volume, low-cost generic pesticides such as glyphosate and glufosinate, most of which went off-patent before 2005. India, on the other hand, exhibits a more diversified product portfolio.

India's Unique Advantages in Pesticide Exports

A significant characteristic of India's pesticide exports is that patented and proprietary molecules account for approximately 40% of the total, a stark contrast to Chinese enterprises. Among India's key export products to the US, Pyroxasulfone leads with an export value of $167 million, its patent set to expire in 2026. Sulfoxaflor exports reached $39.8 million, with its patent valid until 2027. These patented molecules are primarily supplied by companies such as PI Industries and Deccan Fine Chemicals.

In the generics segment, Indian companies also perform well. Metribuzin exports amounted to $68.2 million, while Bifenthrin and Dicamba reached $67.2 million and $66 million respectively. These traditional generics are mainly dominated by companies like UPL, Atul, and Rallis.

Indian pesticide companies have been able to secure an important position in the US market due to several advantages: primarily, technological barriers, as Indian companies have accumulated rich experience in complex processes and patented molecule production; secondly, quality assurance, with most major companies having obtained international quality certifications; furthermore, India possesses a clear cost advantage compared to European and American companies, and currently benefits from tariff protection against Chinese products, all of which have provided a favorable competitive edge for Indian companies in the US market.

Direct Impact of 50% Tariffs

Once the US imposes a 50% tariff on Indian pesticides, it will severely impact Indian companies. From a price perspective, the current average price of Indian pesticides in the US market is $23,400 per ton; with a 50% tariff, this will surge to $35,100 per ton. In contrast, the average price of Chinese products is only $12,400 per ton, meaning Indian products will significantly lose their price competitiveness.

Different product categories will face varying degrees of impact. For patented molecules, due to technological barriers and patent protection, substitutability is relatively limited in the short term, but in the long run, multinational corporations are likely to seek alternative suppliers. For generic products, which compete directly with Chinese products and are highly price-sensitive, a substantial loss of market share is anticipated.

Based on trade elasticity analysis, the 50% tariff is expected to cause a 40-60% decrease in India's total pesticide exports to the US. In terms of export volume, it is projected to drop by 45-65%, from 47,000 tons to 16,000-26,000 tons. Specifically, patented pesticide exports are expected to decline by 20-30%, while generic pesticide exports might see a reduction of 60-80%.

Challenges for Key Enterprises

For leading Indian pesticide companies, the 50% tariff will bring differentiated impacts. PI Industries, as a company focused on patented molecules, sees the US market accounting for 25-30% of its total revenue. Its key products, such as Pyroxasulfone, will face direct impacts. UPL Limited, a company primarily focused on generics, faces even more severe challenges, with US operations contributing approximately 20% to its global revenue. Aarti Industries, a significant intermediate supplier, although not directly exporting finished products to the US, will also be indirectly affected. Companies like Rallis India, which specialize in formulated product exports, are also under immense pressure, with their US market revenue expected to decline by 40-50%.

Opportunities Amidst the Crisis

While the 50% tariff will significantly impact the Indian pesticide industry, the crisis also presents opportunities for development. Firstly, external pressure will compel the industry to accelerate technological upgrades, pushing companies towards higher value chains. Secondly, forced market diversification will lead companies to establish a more balanced and stable global footprint. Finally, a re-evaluation of the industry's value chain will prompt companies to find the optimal balance between specialization and integration. In this process, India may proactively or passively move closer to China, transforming the "Dragon-Elephant rivalry" into "Dragon-Elephant cooperation."